Free Credit Card Ach Authorization Forms Pdf Word Eforms

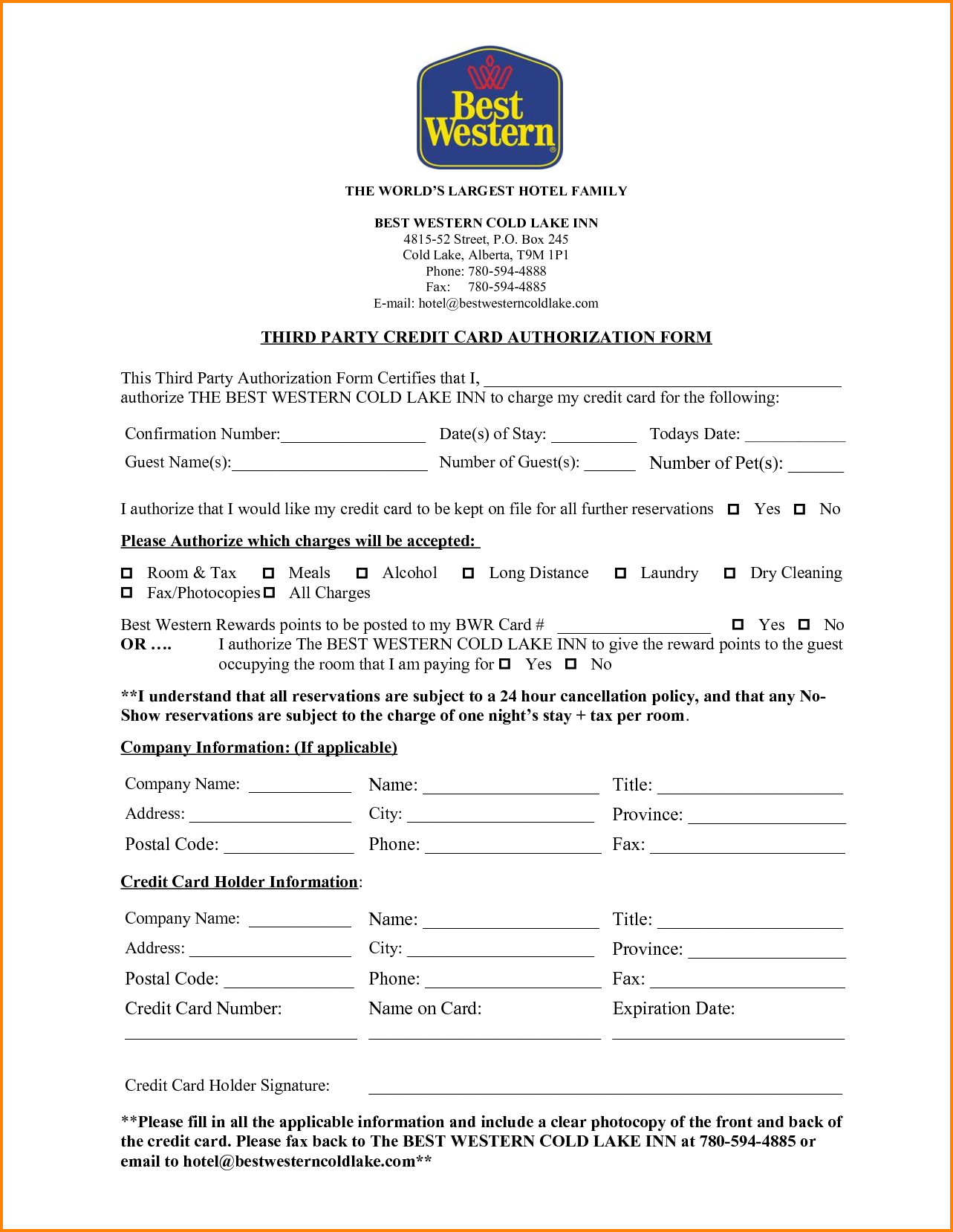

Register and subscribe now to work on tax release authorization & more fillable forms. 1 pdf editor, e-sign platform, data collection, form builder solution in a single app. Please be advised, this letter serves as my (our) authorization for the release of my (our) credit history information with your firm. thank you for your cooperation in this matter. signature signature of joint applicant ( if any ). A credit card authorization form is a document, signed by a cardholder, that grants a merchant permission to charge their credit card for a period of time as written in that document. the form is often used to give businesses the ongoing authority to charge the cardholder on a recurring basis — whether that’s monthly, quarterly, or more. The credit release form comes in question when the bank or the credit company needs to approve some information of the client before the application is approved or processed. in other words, this credit release allows the bank or the credit company to approve for the loan or credit card with full background information of the client asking for it.

Sign Documents Online

Employment Application

Credit card authorization form please complete all fields. you may cancel this authorization at any time by contacting us. this authorization will remain in effect until cancelled. credit card information card type:☐ mastercard☐ visa☐ discover☐ amex ☐ other _____. Credit cards allow for a greater degree of financial flexibility than debit cards, and can be a useful tool to build your credit history. there are even certain situations where a credit card is essential, like many car rental businesses an. Get an information release form using our simple step-by-step process. start today! easily customize your information release form. download & print anytime. Whether you’re starting your own small business or you’re already running one, its continued financial health is one of the most important things to keep in mind. for some extra security to fall back on if times get tough or to release authorization credit card help build y.

The credit report authorization form is a document that release authorization credit card is used to give permission to an individual or organization to perform a credit report only. this form provides broad language that allows a credit report to be generated for any type of legal reason in compliance with the fair credit reporting act (fcra) (15 u. s. c. § 1681). • mismatching transaction id between the frst authorization and the incremental authorizations important: the frst authorization (estimated/initial) determines the fnal transaction characteristics (i. e. whether a transaction took place in a card present or card not present environment). Download or email 756-020z & more fillable forms, register and subscribe now!. High-quality, reliable legal release developed by lawyers. create now. download yours at no cost.

Credit Card Authorization Hold What It Is And How To Use It

Placing authorization holds for credit and debit card transactions is a smart, safe, and easy way for merchants to protect themselves from fraud, chargebacks, and unnecessary refunds. while their usage is common within certain industries, most merchants accepting credit cards can—and should—take advantage of this helpful tool. 1-time credit card authorization a general form release authorization credit card for a charge that will be made for a single payment on a credit card. download: adobe pdf ms word (. docx) opendocument recurring credit card authorization the act of using an individual’s or business’s credit card for a charge that will repeat in a timely period (usually on a. A credit card pre-authorization is much like any other charge to a credit card, except instead of actually debiting funds from the cardholder you just put a temporary "hold" on the funds that lasts for 5 days. at a technical level, the actual duration of the hold depends on the merchant classification code (mcc code).

A secured credit card is just like a regular credit card, but it requires a cash security deposit, which acts as collateral for the credit limit. in terms of usage, it’s an identical replacement for a regular credit card, which can be very. Whether you are looking to apply for a new credit card or are just starting out, there are a few things to know beforehand. here we will look at what exactly a credit card is, what the benefits and detriments to having one are, what first-t.

A pre-authorization (also “pre-auth” or “authorization hold”) is a temporary hold a customer’s credit card that typically lasts around 5 days, or until the post-authorization (or “settlement”) comes through. When people go shopping for a new credit card, they want to make a decision based on what their particular needs are. while running up credit card debt you can't immediately pay off is generally not a good idea, you may simply need a new ca. In the case of debit cards, authorization holds can fall off the account, thus rendering the balance available again, anywhere from one to eight business days after the transaction date, depending on the bank's policy. in the case of credit cards, holds may last as long as thirty days, depending on the issuing bank. The pre-authorization is voided on our end immediately. however, the time release depends on your individual credit / debit card bank. once posted, it typically takes 2-3 days for release authorization credit card the pre-authorization charge to be removed by your bank.

Many banks offer credit cards with great benefits for travelers. when looking for a credit card for travel, it's important to determine which benefits are right for you. some offer miles for airlines, while others give you points on hotels. This article covers what you are able to do in regards to releasing an authorization hold on a cardholder's credit card. note: authorization holds occur at the bank level. shift4 can't force a cardholder 's bank to release an authorization hold, shift4 can only assist in requesting the release of the authorization. Some people believe that you should avoid getting a credit card as they generate debt. however, without one you will be missing out as they offer protection when buying items online. they are also one of the best ways of spending when you j.

Authorization hold (also card authorization, preauthorization, or preauth) is a service offered by credit and debit card providers whereby the provider puts a hold of the amount approved by the cardholder, reducing the balance of available funds until the merchant clears the transaction (also called settlement), after the transaction is completed or aborted, or because the hold expires. The main challenge many people with bad credit face when applying for a credit card is having a limited number of good options. establishing a positive payment history on a new credit card account is one of the best ways to start improving.